- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Pakistan Stock Exchange was established on September 18, 1947 and was formally incorporated on March 10, 1949 under the name of ‘Karachi Stock Exchange’, as a Company limited by Guarantee. In October 1970, a second stock exchange was established in Lahore to meet the stock trading needs of the provincial metropolis. In October 1989, Islamabad Stock Exchange was established to cater to the investors of the northern parts of the country. Because the three exchanges had separate management, trading interfaces, indices, and had no mutualized structure, therefore the Stock Exchanges (Corporatization, Demutualization and Integration) Act, 2012 was promulgated by the Government of Pakistan which ultimately resulted in the three exchanges integrating their operations effective January 11, 2016 under the new name ‘Pakistan Stock Exchange Limited’ (PSX)

PSX has made significant strides in its history, having a small presence of 5 listed companies initially with a total paid-up capital of Rs 37 Mn. In 1960 there were 81 companies with a market capitalization of Rs 1.8 Bn whereas now there are 527 (+7 GEM Board) companies listed on the bourse with a market capitalization of PKR 15.2 Trillion. The listed companies are distributed amongst 38 sectors/ groups of industries.

*As of June 30, 2025

With a vision of becoming one of the leading exchanges of the world, PSX has an enviable record of being the best performing stock exchange in Asia and recently, the best performing stock market in the world. The KSE-100 recorded a staggering return of 60.15% (~57% in USD) for FY2025. PSX is at the forefront of capital formation in Pakistan’s economy, being the national stock exchange of the country and the frontline regulator of the capital market of Pakistan. PSX has in place technological, operational and regulatory strengths of highest standard. With a cutting edge, high performance and future ready New Trading & Surveillance System (NTS), a progressive regulatory framework and innovative new products and services such as ETFs, Online Account Opening, Sahulat Account, PRIDE portal for listing facilitation and ‘My Portfolio’, the virtual trading tool. Currently, 17 indices are listed on PSX as follows*:

*As of 30th June, 2025

The objective of PSX is to provide a safe, reliable, efficient and consistent marketplace where investors can buy and sell common stock of listed companies and other securities. For over 75 years, the Exchange has facilitated capital formation, serving a wide spectrum of participants, including individual and institutional investors, the trading community and listed companies.

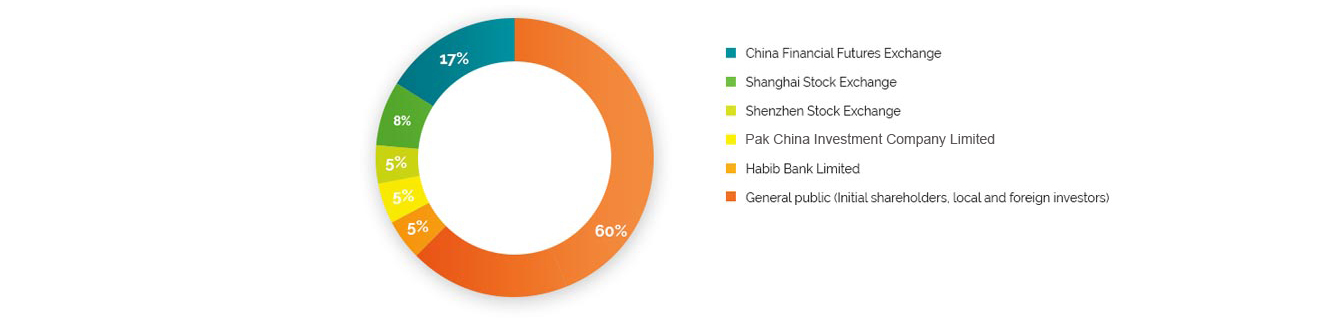

PSX constitutes of 40% shareholding by a consortium of Chinese investors (Shanghai Stock Exchange, Shenzhen Stock Exchange, & China Financial Futures Exchange), and 60% by general public, which includes initial shareholders, local and foreign investors.