- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Climate change poses one of the greatest global challenges today, calling for innovative financial solutions. In the developing world, especially within the Islamic community, there is a rising demand for instruments that are both environmentally sustainable and Shariah-compliant. Green Sukuk offers such a solution—a Shariah-compliant bond crafted to fund eco-friendly projects.

To grasp the significance of Green Sukuk, we must first understand sukuk. Sukuk is an Islamic financial product, a Shariah compliant alternative to a conventional bond, based on Islamic principles. Unlike traditional bonds that pay interest - which is prohibited in Islam as “riba” - sukuk works differently. The issuer sells certificates to investors, using the funds to invest in tangible assets, such as infrastructure or property, in which investors gain partial ownership. The issuer promises to buy back these certificates at their original value after a set period, linking returns to the asset’s income in the form of rental and ensuring adherence to Islamic principles.

Since its introduction in Malaysia in 2000, followed by Bahrain in 2001, sukuk has gained global traction. Today, Islamic firms and governments widely use sukuk, contributing significantly to the international fixed-income market. By tying investments to tangible assets, sukuk aligns with Islamic financial ethics, offering investors ownership stakes rather than debt claims.

Green Sukuk takes this concept further, directing Islamic investments into renewable energy and other environmentally focused projects. It reflects Shariah’s emphasis on environmental care, with funds used for initiatives like building solar plants, retiring construction debt, or supporting green subsidies approved by the government. Often, it involves securing future income from specific eco-friendly assets or projects.

The global green bond market has surged in recent years, and Islamic finance is well-positioned to tap into this trend. This growth shows how capital markets worldwide are prioritizing climate considerations, a movement mirrored in Islamic finance through Green Sukuk issuances, including sovereign Green Sukuk. Case studies from various countries highlight how sukuk finances certified green projects, revealing enabling factors, challenges, solutions, and valuable lessons learned.

Pakistan is among the world’s most climate-vulnerable nations, despite contributing less than 1% to global carbon emissions. The country faces frequent climate challenges; floods, droughts, heatwaves and long-term risks like glacial melt and water scarcity. The 2022 floods, which displaced millions and caused billions of dollars in losses, highlight the urgent need for climate-resilient infrastructure. Green Sukuk provides a powerful tool to meet this need.

By raising funds for large-scale projects like dams, flood walls, and renewable energy, Green Sukuk helps Pakistan reduce reliance on conventional debt. It offers a sustainable way to address energy shortages and reduce dependence on imported fossil fuels. Shifting to clean energy sources such as solar, wind, and hydropower through Green Sukuk can cut energy costs and lessen environmental harm.

Pakistan’s thriving Islamic finance sector makes it an ideal candidate to leverage Green Sukuk, attracting investments from Islamic banks, sovereign wealth funds, and global ESG-focused investors who prioritize ethical, green projects. This not only boosts Pakistan’s global financial standing but also positions Islamic finance as a leader in sustainability.

Green Sukuk aligns with the Maqasid al-Shariah, the core objectives of Islamic law, which include preserving life, property, and the environment. It promotes sustainable development, environmental stewardship (khalifah), and the principle of avoiding harm (dharar), as noted in the World Bank Report. By offering a Shariah-compliant way to access global capital markets, Green Sukuk enables Islamic countries to uphold their values while pursuing sustainable growth.

Countries like Malaysia, Indonesia, Saudi Arabia, and the United Arab Emirates have successfully issued Green Sukuk, funding projects from clean energy to reforestation. By embracing this instrument, the Islamic world can lead in ethical and green finance, blending financial innovation with moral responsibility. This approach supports the United Nations Sustainable Development Goals (SDGs), establishing Islamic finance as a key player in global sustainability.

As major economies adopt sustainable business practices, Pakistan is recognizing the potential of sustainable investing. This approach integrates Environmental, Social, and Governance (ESG) factors into investment decisions, offering long-term financial benefits while tackling pressing issues like climate change, gender inequality, and socio-economic development. For a country facing both challenges and opportunities, sustainable investing is not just a strategy but a necessity.

With a young, growing population, rapid urbanization, and significant infrastructure needs, Pakistan requires capital to create jobs, reduce inequality, and drive clean, resilient growth. The Global Climate Risk Index ranks Pakistan among the top climate-affected nations, with floods, rising temperatures, droughts, and air pollution threatening agriculture, health, and the economy. Social challenges - gender inequality, poor education, youth unemployment, and limited healthcare - further hinder inclusive growth, while weak governance affects transparency and investor trust.

Sustainable investing bridges the government’s development goals with the financial market. By channeling capital into ESG-compliant projects, Pakistan can foster sustainable businesses, promote climate action, and build a more inclusive economy. In countries like Malaysia and Indonesia, capital markets are providing affordable, long-term financing through green bonds, supporting cities, municipalities, and low-carbon infrastructure. Pakistan, with its robust Islamic finance platform, can develop Shariah-compliant instruments that also prioritize sustainability, funding clean energy, social housing, and infrastructure while meeting both faith-based and ESG standards.

Marking a significant step in its sustainable finance journey, the Government of Pakistan has launched its first domestic Green Sukuk with a target issuance size of PKR 30 billion. This issuance will occur through an auction process, with the Pakistan Stock Exchange (PSX) - along with its infrastructure partners NCCPL and CDC - playing a key role in listing and promoting this innovative instrument. This move will transform Pakistan’s sukuk market by directing investments into eco-friendly projects, boosting economic growth, and aligning with international green financing standards. It reflects the government’s firm commitment to sustainable development through financial markets.

Green Sukuk highlights Pakistan’s dedication to lowering its carbon footprint while providing investors with a chance to support green initiatives. It represents a unique blend of faith, finance, and sustainability, enabling Pakistan to fund climate-resilient and clean energy projects in a Shariah-compliant way. Individuals, small to mid-sized investors, and organizations interested in joining the Green Sukuk auction can participate through licensed brokerage houses of Pakistan Stock Exchange, making this opportunity accessible to a wide range of stakeholders.

Imagine this: Ayesha, a schoolteacher in Faisalabad, sips her morning tea while scrolling through her phone. She stumbles upon a news headline: “Pakistan Stock Exchange (PSX) soars 84% in 2024!” Intrigued, she wonders, Could I invest too? Isn’t the stock market only for the wealthy or experts? Later, she learns that over 75% of daily traded value on PSX comprises of Shariah-compliant stocks. “Wow,” she thinks, delighted, as she has always wanted her hard-earned money to grow in a Shariah-compliant way. Like many Pakistanis, Ayesha once thought investing was out of reach. But her journey into the stock market changed everything—and it could change yours too.

The stock market once seemed like a distant, complex world, reserved for financial wizards. But today, with digital tools and accessible information, anyone—teachers like Ayesha, young graduates, doctors, housewives or on job professionals—can unlock its potential. The Pakistan Stock Exchange (PSX), the country’s sole stock exchange formed by merging the Karachi, Lahore, and Islamabad exchanges, can be your gateway to building wealth.

So, what is the stock market? Picture a bustling marketplace where buyers and sellers trade shares—small pieces of publicly listed companies. When you buy a share, you own a fraction of that company, whether it’s a bank, an energy firm, or a consumer goods giant. As a shareholder, you may earn dividends (a share of profits) or capital gains if the share price rises. For those seeking Shariah-compliant investments, PSX offers options like the KMI-30 and KMI All Share Islamic indices, which contains those companies that align with Islamic finance principles. It is worth mentioning that more than 50% of the companies listed at PSX are Shariah-compliant.

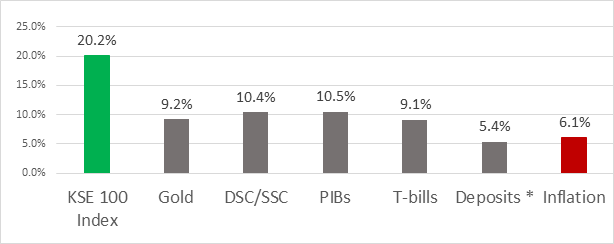

Ayesha’s First Steps: Starting Small, Dreaming Big - Ayesha was cautious. “What if I lose everything?” she worried. But she learned that the stock market offers unique advantages over traditional savings like fixed deposits or real estate:

To start, Ayesha opened a Sahulat Account with a licensed PSX broker, requiring only her CNIC. She began with a small sum, focusing on “blue-chip” stocks (shares of stable, profitable and well-established companies). She also explored Exchange Traded Funds (ETFs), which bundle multiple stocks for instant diversification, perfect for beginners wary of market swings. She also explored the option to buy Sukuk (Shariah-compliant debt instruments issued by the government) offering stable returns and aligning with her ethical values.

Learning the Ropes: Knowledge is Power - Ayesha didn’t dive in blindly. She explored PSX’s free resources to build her confidence:

She set clear goals: save for her daughter’s education and build a retirement nest egg. Ayesha learned to take a long-term view, resisting the temptation to chase quick profits. “The stock market rewards patience,” her broker advised. She diversified her portfolio, mixing defensive stocks (like utilities) with growth stocks (like tech firms), and even picked dividend-paying stocks for steady income.

Navigating Risks: Ayesha’s Smart Moves - The stock market isn’t a guaranteed win. Ayesha faced risks but learned to manage them:

Smart and prudent, Ayesha didn’t invest all her savings. She set aside an emergency fund for unexpected needs and allocated only the remaining funds for long-term investments, knowing the stock market tends to yield higher returns over time. By carefully managing her risks, she ensured her investments aligned with her financial goals and risk tolerance.

Ayesha stayed informed, following local news, policies from the State Bank of Pakistan and global trends like trade wars. She reinvested her dividends, harnessing the power of compounding to grow her wealth over time Ayesha stayed informed, following local news, policies from the State Bank of Pakistan and global trends like trade wars. She reinvested her dividends, harnessing the power of compounding to grow her wealth over time.

The Bigger Picture: Trust and Transparency - The Securities and Exchange Commission of Pakistan (SECP) regulates PSX, ensuring transparency and protecting investors. Ayesha chose a reputable broker from PSX’s approved list, avoiding schemes promising “quick riches.” She learned her rights as an investor through SECP guidelines, building trust in the system.

Ayesha’s Triumph: From Doubt to Confidence - Months later, Ayesha’s small investments grew steadily. Her portfolio wasn’t just numbers on a screen—it was a step toward her dreams. She wasn’t rich overnight, but she felt empowered, knowing her money was working for her. Whether saving for a house, an emergency fund, or retirement, the stock market offered endless possibilities.

Today, Ayesha is not only an active investor, she is also teaching her students basics of stock market. Ayesha knows that by investing in the stock market, not only she can achieve her financial goals but also contribute to Pakistan’s economic growth. When people invest in companies listed on PSX, they provide capital that fuels business expansion, job creation, and innovation. This strengthens industries like banking, energy, and technology, boosting the nation’s economy. A thriving stock market attracts foreign investment, stabilizes the rupee, and fosters sustainable development, creating a brighter future for all Pakistanis.

Your Turn to Start Your Journey - Ayesha’s story shows that the stock market isn’t a mystery—it’s a tool for anyone willing to learn. Start small, educate yourself with PSX’s free tools, and invest with discipline. Time is your greatest ally. With patience and calculated risks, the PSX may help you turn financial aspirations into reality. Open an account today, and take your first step toward prosperity.

Disclaimer: Investments in the Stock Market are subject to market risks. The prices of securities may go up or down depending upon the factors and forces affecting the securities market including but not limited to the fluctuations in the interest rates. Investors are requested to review all details carefully and obtain expert professional advice before making any decision relating to the purchase or sale of security in the Stock Market.

In today’s fast-evolving digital landscape, cybersecurity has become a top priority for financial institutions worldwide. As the backbone of Pakistan’s capital market, Pakistan Stock Exchange (PSX) is committed to maintaining the highest standards of information security, risk management, and operational resilience. In line with this commitment, we are proud to announce that PSX has successfully achieved ISO 27001:2022 certification, a globally recognized standard for Information Security Management Systems (ISMS).

This achievement underscores our unwavering dedication to protecting sensitive market data, investor information, and financial transactions from evolving cyber threats. It also reflects our proactive approach to regulatory compliance, risk mitigation, and business continuity, ensuring that PSX remains a secure, resilient, and globally credible financial marketplace.

Achieving ISO 27001:2022 certification was not an individual feat but the result of a concerted effort from all PSX departments. Every team within the organization—including Information security, Risk Management, IT, Operations, and Business Units—played a pivotal role in implementing strong security controls, governance frameworks, and risk mitigation strategies.

The certification process involved a rigorous assessment of PSX’s security policies, procedures, and technical controls, ensuring that they align with international best practices. By fostering a culture of collaboration and vigilance, we have established a security framework that meets global security standards.

ISO 27001:2022 is an internationally recognized information security standardthat provides a structured approach to identifying, managing, and mitigating security risks. Organizations that achieve this certification demonstrate their ability to safeguard sensitive information, maintain regulatory compliance, and uphold the trust of stakeholders and investors.

For PSX, this certification signifies:

1. Enhanced Data Security

It ensures confidentiality, integrity, and availability, and also strengthens data encryption, access controls, and threat detection mechanisms to safeguard critical assets.

2. Risk Mitigation and Cyber Resilience

It enables PSX to proactively identify vulnerabilities, implement preventive measures, and respond effectively to security incidents. This minimizes the risk of data breaches, unauthorized access, and cyberattacks.

3. Increased Stakeholder Confidence

Security is a key factor in maintaining trust among brokers, traders, investors, and regulatory authorities. By achieving ISO 27001:2022 certification, PSX provides stakeholders with the assurance that their financial and trading data is protected under globally recognized security frameworks.

4. Investor Trust and Market Stability

A secure stock exchange fosters investor confidence and market stability. Investors can trade with the assurance that PSX follows the highest security standards, reducing the risk of cyber incidents, and operational disruptions.

5. Global Credibility and Competitive Edge

Achieving ISO 27001:2022 enhances PSX’s reputation on the global stage. As the only Exchange in Pakistan, it is prudent to comply with international security best practices to attract global investors and market participants. This certification strengthens our position as a trusted exchange within the international financial ecosystem.

6. Business Continuity and Operational Resilience

PSX operates in a

fast-paced and high-volume trading environment

where downtime is not an option. The structured risk management framework of ISO 27001:2022 ensures that PSX remains operational even during cybersecurity incidents, technical failures, or unforeseen disruptions.

7. Regulatory Compliance and Legal Protection

The financial sector is subject to stringent regulatory requirements. Achieving ISO 27001:2022 certification ensures that PSX meets both local and international legal obligations, reducing the risk of non-compliance penalties and reputational damage.

While achieving ISO 27001:2022 certification is a significant milestone, it is not the final destination. Cyber threats are constantly evolving, and we recognize the need for continuous improvement in our security practices. PSX remains dedicated to:

This achievement would not have been possible without the hard work, dedication, and expertise of our Information security professionals, IT team, Risk team, and all PSX departments. Their efforts in implementing strong security controls, governance structures, and risk mitigation strategies have played a crucial role in securing this certification.

The successful achievement of ISO 27001:2022 certification reinforces PSX’s position as a leader in information security within Pakistan’s financial sector. As cyber threats grow in complexity, we remain committed to adapting, evolving, and strengthening our security frameworks to protect market integrity.

At PSX, security is not just a requirement—it is a core value that drives our operations and decision-making. This certification serves as a foundation for future innovations, enhanced risk management, and continued growth in the digital financial ecosystem.

Pakistan Stock Exchange is ready for the future—secure, resilient, and committed to excellence.

By: Babar Ahmed

Chief Information Security Officer (CISO)

Pakistan Stock Exchange (PSX)

Published On: March 15, 2025

The stock exchange plays a vital role in shaping a country’s economic landscape. In Pakistan, the Pakistan Stock Exchange (PSX) serves as the backbone of financial markets, providing businesses with access to capital and offering investors an opportunity to grow their wealth.

Despite its significance, a large portion of the general public remains unaware of the benefits of investing in stocks, limiting economic growth and individual financial prosperity.

Understanding the Role of the Stock Market in the Economy

A well-functioning stock exchange contributes to economic growth in multiple ways:

1. Capital Formation and Business Growth

The stock market allows companies to raise funds by issuing shares, enabling them to expand operations, innovate, and create employment opportunities. Successful businesses strengthen the economy by increasing productivity and tax revenues.

2. Wealth Creation for Investors

Investing in stocks offers individuals a chance to grow their savings. Over time, well-performing stocks yield significant returns, helping investors accumulate wealth and achieve financial stability.

3. Economic Stability and Development

A thriving stock market reflects investor confidence and economic stability. When the PSX performs well, it signals a robust economy, attracting foreign investments that fuel further growth.

4. Reducing Dependence on Foreign Loans

By encouraging local investment, the stock exchange reduces the need for foreign borrowing, which often comes with high-interest rates and economic dependencies. A stronger stock market means Pakistan can rely more on domestic resources for economic development.

Why the General Public Hesitates to Invest

Despite these advantages, many Pakistanis hesitate to invest in the stock market. Some of the key reasons include:

Encouraging Public Participation in the Stock Market

To make stock investment more accessible to the general public, the following steps can be taken:

Conclusion

The Pakistan Stock Exchange is a crucial driver of economic growth and financial empowerment. By bridging the knowledge gap and making investing more accessible, Pakistan can unlock the true potential of its stock market. Now is the time for the general public to step forward, learn about stock investments, and become active participants in shaping the country’s financial future.

Ahmed Chinoy H.I, S.I

Director Pakistan Stock Exchange Ltd

Published On: August 21, 2024

Pakistan Stock Exchange (PSX) presents a highly respected and prestigious award to highlight and celebrate the achievements of top 25 companies who have met certain qualitative and quantitative criteria in terms of their performance. The PSX Top 25 Companies Award is presented to listed companies who have excelled in both corporate governance and financial performance.

The Top 25 Companies Awards was established in 1978 and the very first award distribution ceremony was held in 1980. The objective of PSX Top 25 Companies Awards is not only to reward and recognise the listed companies meeting criteria of excellent performance, but also to set an example and benchmark for other listed companies to follow. At the same time, the award-winning companies are highlighted to local and global investors, given that these winning companies have achieved distinction on several grounds such as dividend payouts, capital efficiency and corporate governance metrics, to name a few of the factors against which these companies are selected. More recently, the selection criteria of SDGs and ESG related reporting as well as Diversity & Inclusion were also included in the Top 25 Companies Awards.

The PSX Top 25 Companies Awards is a touchstone for all companies to follow and achieve. The listed companies who win these awards are not only amongst the best performing companies in Pakistan but are also comparable to the best performing companies internationally.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: August 21, 2024

Pakistan Stock Exchange regularly holds Investor Awareness Sessions for the general public including students, academics/ faculty members of universities and colleges, corporate employees, self-employed persons and others. PSX also holds sessions for women in order to promote financial empowerment and awareness amongst them. Furthermore, PSX holds the Investor Awareness Sessions for corporates and companies. These sessions are useful implements to foster financial literacy and education amongst the general public and employees of companies. They are held through in-person or online platforms.

The Investor Awareness Sessions also align with the ‘S’ element of Environmental, Social and Governance considerations. These sessions help promote financial awareness in the society as a whole, and individuals in particular. As a frontline regulator, PSX proactively advocates ESG reporting and adherence. Pakistan Stock Exchange consistently takes steps to foster awareness on ESG for listed companies and stakeholders. As it stands today, companies that report on ESG are sought after by investors as responsible investment takes center-stage globally.

The Investor Awareness Sessions constitute of basics of stock market investment and role of stock market in capital formation & building wealth. The sessions disseminate awareness about savings & investments, asset classes available for investment in Pakistan, ecosystem of the capital market and functioning of the Stock Exchange. The importance of financial planning and various functions & operations of the Stock Exchange are also explained to the participants. The participants are also briefed on ways to navigate PSX’s website & how to access different types of information available on the PSX Data Portal.

The audience profile of the sessions varies from students, employees of corporates & other organisations, self-employed persons, housewives to other members of the general public who can greatly benefit from these sessions. These sessions are held for educational institutions, corporate organisations, chambers of commerce and industries, professional bodies and associations, among others.

Pakistan Stock Exchange, as the frontline regulator and the flag-bearer of Pakistan’s capital markets, recognizes the significance and value of disseminating and fostering investor awareness and education. These sessions are a useful resource for everyone to benefit from by augmenting their financial knowledge. The sessions are mostly free of cost and are a sound contributor to increasing basic financial knowledge and understanding amongst the general public.

PSX understands well that it is through efforts like these that the public can be encouraged towards investing and building wealth for themselves, thereby creating greater opportunities for themselves and securing their future. As the financial well-being of the individuals takes center-stage, this will result in greater economic activity and growth for the country as well.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: August 21, 2024

When investing in the market subsequent to opening an account with a securities broker, investors must be cognizant of their rights regarding investment in the market. From account opening and maintenance, investment process and procedures, to different caveats regarding investment in the stock market, investors must be careful and ensure that their rights are protected. For example, investors must not invest based on any promise of a fixed return or guaranteed returns by a securities broker; furthermore, investors must not authorise any broker to transact on their behalf or carry out trades without explicit permission or authority by the investor.

Investor Complaints Process & Resolution:

In case of any complaints or trade related dispute, the customer may at first lodge a complaint with his/ her securities broker. If the matter is not resolved, the customer may lodge the complaint with the Regulatory Affairs Division (RAD) of PSX to get relief or compensation. The complaint may be lodged by submitting a prescribed Investors’ Complaint Form (available on PSX website) at investor.complaints@psx.com.pk once an investor files a complaint, PSX takes up the matter with the concerned securities broker and initiates the process of the complaint resolution initially through mediation.

Arbitration:

If the matter still stands unresolved, despite mediation, then Arbitration is employed in accordance with procedures prescribed under Chapter 18 of PSX Regulations. Arbitration is a process of dispute resolution whereby a customer can settle their disagreement with the broker efficiently outside the Court. Any party to the dispute, whether investors alleging mismanagement of their funds or securities brokers for recovery of debit amounts, may file for Arbitration through an application to RAD supported by relevant documentary evidences. If the disputed amount is above Rs 1,000,000, then the Arbitration is carried out by a panel comprising of industry experts, CEOs of brokerage houses, and representatives of PSX senior management staff. The Arbitration panel provides equal opportunity of hearing to all parties involved in the dispute. In case the disputed amount is less than Rs 1,000,000, then the sole arbitrator who may be one industry expert hears and decides on the dispute. A decision is made after significantly reviewing the entire matter from all angles. If any party to the dispute is dissatisfied with the Arbitration result, they may file an appeal with the PSX Chief Regulatory Officer (CRO) within 15 working days of the decision. Subsequently, an Appellate panel comprising of five arbitrators including industry experts and PSX senior management staff will hear and decide on the Arbitration decision against which the appeal is being made within 45 days of the receipt of the appeal.

Default by a Securities Broker:

In case of default by a securities broker, a customer wanting to lodge a complaint against the said securities broker in respect of claiming funds, can do so by contacting the PSX Regulatory Affairs Division (RAD). The process involves formation of a Default Committee by PSX for handling such matters, inviting claims against defaulting securities brokers through PSX website and advertisements in newspapers, appointment of auditor for verification of claims, and disbursement of available funds to approved claimants.

The approved claims of defaulter securities brokers are settled by PSX through liquidation of assets of the securities broker and through the Base Minimum Capital (BMC) maintained with the Exchange in accordance with Chapter 19 of PSX Regulations. If the customers’ claims admitted by the Exchange against a defaulted securities broker are more than the amount available out of sale proceeds of assets of such securities broker and through the BMC for satisfying such claims, then remaining amount shall be paid from Centralised Customers Protection Compensation Fund (CCPF), established by the Exchange with the sole mandate to compensate customers of a defaulter securities broker, up to a maximum of Rs 1,000,000/- per claimant, in accordance with Chapter 24 of PSX Regulations.

While there are comprehensive measures in place to protect investors by PSX as a frontline regulator, the saying that “prevention is better than cure” or “better be safe than sorry” is the most apt in this situation. Being careful and investing responsibly is the best guarantee that an investor can have in terms of protecting his/ her investment and assets.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: August 21, 2024

Pakistan Stock Exchange’s ‘My Portfolio’ is a dynamic, educational, real-time based virtual trading platform. This web-based trading platform is designed for students, employees, business persons, market enthusiasts and the general public who wish to learn more about and practice investing. It is an ideal tool enabling creation of different portfolios and seeing the results of investment strategies in the stock market. To put it briefly, users of this platform can learn about the commissions & deductions, stocks & their symbols, and dividends, among other aspects of investing on the stock market. Through this tool, participants will also learn about their portfolio dashboard, diversification, and gauge their profits and losses.

My Portfolio is a risk-free way to learn about investing in stocks, thereby engaging in this productive activity with no cost and in a safe way. Learn how to build a virtual portfolio of stocks and how to subsequently track it through the dashboard of My Portfolio. Here you can add on an existing portfolio, add a new portfolio, buy & sell shares, and track your portfolio position with ease. Following are some tips and guidelines on using My Portfolio.

To use My Portfolio, click on ‘My Portfolio’ on the menu bar at the top of the Data Portal. To begin, create an account & sign up by adding your basic information and set up a password.

Next, create your first portfolio. Add in the name of the portfolio, specify the cash amount you want to virtually deposit against your portfolio, the tracking date of the portfolio, and a brief description of the type of portfolio this is going to be, whether it’s a portfolio focused towards capital gain, dividend income or any other form as per your preferences.

Upon clicking on Create Portfolio, your portfolio will be created showing a dashboard with your cash position. Now you can start adding shares or stocks to your portfolio by clicking on Make A Trade.

For the Buy Transaction, enter the symbol name of your selected stock pick, transaction date through the drop-down calendar, the stock quantity to be purchased, as well as the share price. The share price can be entered manually or fetched automatically. Then enter the brokerage fee as per your preference.

After Submitting the Buy transaction, you are presented with your portfolio position. Here you are shown the portfolio dashboard, the portfolio trend, the breakdown or graphical presentation of your portfolio as well as a tabular display of your portfolio. Through Make A Trade, you can enter multiple buy transactions.

For the Sell transaction, select a symbol of your stock pick, the transaction date through the drop- down calendar date, and the stock quantity for sale. Next, enter the share price you want to sell the shares at and the brokerage commission.

After submitting the Sell Transaction, your portfolio position is again presented to you incorporating the latest position of your portfolio of shares. Here you can see the details of your portfolio in terms of today’s returns, total return or gain/ loss, market value of equities, cash balance as well as total portfolio value. The portfolio trend shows the daily return chart of your portfolio. It is updated at the close of each trading day. The pie chart on the right of the portfolio trend shows the distribution of your portfolio in terms of equities and sectors. At the bottom, you are shown your portfolio position in a tabular form, with the Summary displaying the quantity of shares, average cost, current price, gain/ loss and the weight of each holding in the portfolio. Through the Transaction History, you will be able to track your transaction history on different dates.

You can also create multiple portfolios in similar way and switch between your portfolios. My Portfolio is a comprehensive tool enabling you to participate in stock trading and investment with zero risk and zero loss possibility. It is an extremely useful tool designed to help you understand investing on the stock market in a complete and productive way.

The My Portfolio Contest was also held to promote investor awareness and education. The winning contestants were awarded attractive prizes while learning the ropes of investing on PSX. By participating in My Portfolio Contest, the contestants were able to learn about investing, building a portfolio and taking investment decisions. Moreover, they could learn about stock prices, stock symbols and much more.

The contest was a three-month long activity in which the users were allocated PKR 10 million virtual cash in their portfolio and, during the provided timeline, users were asked to invest and trade by buying and selling shares. The top performing portfolios, in the final analysis, were rewarded. The contest was focused on encouraging potential investors to explore the market, make the right decisions and learn from their mistakes without incurring any real cash losses.

You can learn more about My Portfolio by accessing the video tutorial available at the following PSX You Tube account link:

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: August 21, 2024

For all investors investing in the capital market, it is extremely important that they know and understand their rights regarding investor protection and the rules & regulations thereof. At the outset, when a potential investor is to open a trading account with a securities broker, he/ she must ensure that the broker is a Trading Right Entitlement (TRE) Certificate Holder of Pakistan Stock Exchange and is licensed by the Securities & Exchange Commission of Pakistan (SECP). A customer can verify if a securities broker is a TRE Certificate holder by visiting the PSX website and verifying the registration details of the brokerage firm along with its registered office and branches.

Account Opening & Maintenance:

When opening an account, customers are advised to ensure that the Customer Relationship Form (CRF) or Sahulat Account Opening form containing the minimum Terms & Conditions (T&Cs) should be read, understood and signed by them. Infact, all relevant fields of the CRF must be properly filled out and irrelevant fields may be struck off. Moreover, the T&Cs, annexed to the CRF/ Sahulat Account Opening forms provided to account holders must be duly stamped, dated and signed by the Compliance Officer of the securities broker on each page.

Investors are advised to open accounts in their own name only and encouraged to operate their account themselves. Investors are encouraged to open CDC Investor Accounts for safer custody of their shares. In case they want to authorise someone else to transact on their behalf, then a relevant authorisation must be furnished in writing to the concerned securities broker whilst a copy of the authorisation may be maintained by the account holder. Account holders are further recommended to keep track of all alerts, emails, messages or documents sent to them in respect of their account by their securities broker, as well as CDC and NCCPL. Account holders must also sign and verify the correctness as well as completeness of their UIN Post Report and CDC Setup Report.

Orders & Confirmations:

In order to protect the assets of investors, there are certain guidelines and regulations outlined by PSX. Account holders holding an account with a brokerage firm must place orders in written form or through recorded lines when placing orders verbally. The brokerage firm, on its part, must provide Trade Confirmations to the customers after execution of each trade. Furthermore, they must provide quarterly statements of the trading account to their customers. Receipts of margin deposits or payments must be provided by the brokerage firms to their customers. Brokerage firms are also required to provide the mandatory tariff structure to their customers.

Investment Process Caveats:

Investors must not invest based on any promise of a fixed return or guaranteed returns by a securities broker. Investors must not authorise any broker to transact on their behalf or carry out trades without explicit permission or authority by the investor. Investors must not make investment decisions based on advice by unlicensed investment advisors or follow any investment advice by unauthorised/ unregistered persons on any unofficial or unregulated social media platform.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: August 21, 2024

Becoming a Trading Right Entitlement Certificate (TREC) Holder of PSX enables the holder to carry out trading of securities at Pakistan Stock Exchange (PSX). The TREC Holders or securities brokers have the advantage of trading for themselves or for their clients. Infact, holding a TRE Certificate enables a securities broker to have more than just the license to trade on PSX.

There are multiple advantages of becoming a PSX TREC Holder. Through this facility, a securities broker gets the opportunity to participate in the multibillion-rupee industry by focusing on corporate equity side as well as the retail brokerage side. The former is geared towards trading for corporate entities such as Asset Management Companies, banks, DFIs etc. and the latter is geared towards facilitating the individual customers such as High Net Worth Individuals and retail investors. TREC Holders can direct their clients to invest in multiple sectors or industries available in the market; from ETFs, Modarabas, mutual funds to futures contracts and others.

By investing and trading for corporate entities, a securities broker can build a strong corporate network which will enable him/ her to capture a share of the institutional market activity. This will enable a securities broker to earn higher revenue streams and liquidity. At present, a TREC Holder can earn 0.15% of transaction value per trade. A TREC Holder can also invest in technology and save money by providing that technology or application to retail clients for investing on the stock market by themselves. This will enable the retail investors to invest directly in the stock market without using the services of an individual securities broker.

Furthermore, TREC Holders can also build partnerships with corporate investors for business development which can add to their revenue streams. Moreover, for both retail and corporate clients, TREC Holders have the option of outsourcing their back-office settlement and other operational processes to a Professional Clearing Member (PCM).

Additionally, TREC Holders can become underwriter for Right Shares issue. They can also become agents for buy-back of shares. As per current rules and regulations, TREC Holders can also act as Advisors for companies wanting to list on the Growth Enterprise Market (GEM) Board of the Exchange, thereby playing their due role of contributing to the growth of the economy. TREC Holders can become market makers as well and can offer government and corporate bonds through the PSX platform.

As mentioned above, there are numerous advantages to becoming a PSX TREC Holder. TREC Holders not only facilitate investors, listing of companies, and market making activity but also contribute to the growth of economic activity in the country.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: April 01, 2024

Pakistan Stock Exchange (PSX) is the national stock exchange of Pakistan. It was established with the name of Karachi Stock Exchange (KSE) on September 18, 1947. It was incorporated on March 10, 1949, under the name of Karachi Stock Exchange (Guarantee) Limited as a company limited by Guarantee. In October 1970, a second stock exchange was established in Lahore by the name of Lahore Stock Exchange (LSE) to meet the stock trading or investment and listing needs of the provincial metropolis of Lahore and its surrounding region. Then in October 1989, a third stock exchange was established in Islamabad by the name of Islamabad Stock Exchange (ISE) to cater to the investors and companies of the northern parts of the country.

Originally, KSE was a small bourse having only five listed companies with a total paid-up capital of Rs 37 million. As the years passed and more companies got listed, the first Index constituting the companies on the bourse was formed. It was called the KSE 50 Index. Gradually, as the number of listed companies and trading activity increased, the need for a truly representative index was felt and the KSE 100 Index was formed on November 1, 1991. Other indices such as the KSE 30 Index and KMI 30 Index along with the recently added sectoral & ETF indices were also added, thus bringing a total of 16 indices on the Stock Exchange.

Stock Exchange is a marketplace to facilitate issuers to raise capital in the form of equity or debt. At the time of initial public offering, the companies make offers in primary market and get themselves listed. Thereafter, trading takes place in secondary market in those listed instruments by the investors through the brokers who are registered with the Stock Exchange as well as Securities & Exchange Commission of Pakistan (SECP). The companies listed on the stock exchange pay return to their shareholders/subscribers, in the form of dividend or mark-up/profit respectively on the investment made in equity or debt.

In the earlier days, trading of shares used to take place through open outcry on the trading floor. This was a traditional way of communication between stockbrokers where verbal communication and hand signals were used for conducting transactions. One stockbroker would communicate that he was interested to buy a stock while another stockbroker would communicate that he was interested in selling a stock. Hence a buy/sell deal was made across the trading pit. The open outcry method was eventually replaced in 2002 by the electronic trading system. The Karachi Automated Trading System (KATS) became operational at the Stock Exchange which was a robust, high performance and high capacity trading system. This was later replaced by the New Trading & Surveillance System (NTS), a cutting edge, future-ready, and robust trading system, which was successfully implemented, installed and adopted in 2023.

The three stock exchanges had separate management, trading interfaces, indices and no mutualized structure. In March 2012, the Stock Exchanges (Corporatisation, Demutualization, and Integration) Act 2012 was passed by the Parliament of Pakistan and in the month of May of the same year, it was signed by the President of Pakistan. By virtue of the said Act, all three stock exchanges were converted into companies limited by shares and it resulted into separation of ownership rights with the trading rights. The brokers were termed as initial shareholders who were issued shares of respective stock exchanges together with Trading Right Entitlement Certificates (TRECs). The said Act also required all the stock exchanges to divest 40% of their equity to strategic/anchor investors and 20% to general public.

In order to implement the condition of divestment of shares laid down in the above-referred Act in letter and spirit, it was felt to have only one stock exchange available for this purpose to the potential investors. As such, the operations of all three stock exchanges were ultimately integrated and a single entity with the name of Pakistan Stock Exchange Limited (PSX) emerged on January 11, 2016. It was followed by sale of 40% equity stake of PSX to Chinese consortium in the end of 2016 and offer of 20% equity stake to general public and self-listing of PSX in June, 2017. As such, PSX is now a commercial entity as well as an active frontline regulator of the capital market.

Many developments have taken place at PSX over the last few years. These include upgradation of PSX technology platform wherein a new Trading & Surveillance System has been implemented at the Exchange as mentioned above. Furthermore, the Exchange has brought forth new technological innovations and conventional developments such as the Online Account which allows investors to open an account digitally, the Sahulat Account which requires a simplified and convenient account opening process, the PSX WhatsApp Service to make available a whole host of information to users on their finger-tips, the My Portfolio virtual trading platform to enable users to learn the ropes of investing through real time trading but with virtual cash, the PSX Knowledge Center, which is a repository of articles, blogs and financial calculators related to the capital markets, and the PSX Glossary which consists of a list of 375 terms and definitions to enhance and increase knowledge on the financial markets. Over the past few years, nine Exchange Traded Funds have also been launched at the Exchange. These ETFs belong to different categories such as those of equities, debt and Islamic.

Ecosystem of the capital market of Pakistan

The ecosystem of the Capital Market constitutes different parts which together enable the working of the Market as a whole. This can be explained via the following diagram:

The companies at the forefront with PSX in the ecosystem of the Capital Market of Pakistan are Central Depository Company of Pakistan (CDC) and National Clearing Company of Pakistan Limited (NCCPL). CDC handles the transfer of shares traded and keep the custody of shares held by investors electronically while NCCPL provides clearing and settlement services of shares and funds against the transactions conducted at the Exchange.

PSX – the premier capital market of Pakistan

Pakistan Stock Exchange lists 524* companies on the Main Board and 3 companies on the GEM Board, representing 37 industrial sectors having a total market cap of over Rs 9.31 trillion. In recent past, PSX outperformed the stock markets of the region by becoming the best performing market in Asia and was also the proud winner of Best Islamic Stock Exchange Award for three consecutive years, 2021, 2022, 2023, presented by Global Islamic Finance Awards (GIFA).

Pakistan Stock Exchange plays a crucial role in the country’s economy as it channels domestic savings and foreign capital to the economic coffers of the country. By attracting interest from local and foreign investors, much needed capital inflows are channeled in the country through PSX. There are more than 313,000 investors investing on the Exchange. Pakistan Stock Exchange provides for an attractive avenue of investments with Price to Earning Ratio of 3.97, which is the lowest in the region and the MSCI Emerging Markets. This is a clear reflection of the attractive valuation of stock prices prevalent at PSX. Not only that, Pakistan Stock Exchange has provided the highest Dividend Yield of 9.38% as compared to other markets of the region and the MSCI Emerging Markets. Not only for investors, but also for companies, PSX is an attractive capital market. By listing on the Stock Exchange, companies can obtain much needed financing to fund their growth, invest in new projects, and increase the country’s exports. Companies listed on the Exchange provide employment and benefits to thousands of Pakistanis and their families and generate significant tax income for the Government of Pakistan.

The writer is Chief Marketing & Business Development Officer

Pakistan Stock Exchange Limited.

Disclaimer:

The contents of this article comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

*(KSE 100 Index Annual Average Return for last 10 years - Feb 28, 2013-Feb 28, 2023)

Source:

Published On: October 01, 2023

Pakistan Stock Exchange (PSX) is the proud recipient of the Best Islamic Stock Exchange Award presented by Global Islamic Finance Awards (GIFA). PSX has not only won this award once but thrice over – first in 2021, then in 2022, and, most recently, in 2023, as well. This is an accolade that is well respected not only in the Islamic world but is also recognised globally.

GIFA is an internationally respected platform recognising excellence in banking and finance in the Islamic world. Since 2011, the Awards have been presented to individuals, institutions and government departments globally who have shown outstanding performance in promoting Islamic banking and finance and in terms of commitment to social responsibility. GIFA is the only global Islamic finance awards programme covering all parts of the world and includes all institutions and individuals who have contributed to growth and expansion of Islamic banking & finance with Sharia authenticity.

Islamic equity and debt products form a large portion of the demand in international capital markets. At present*, PSX lists 251 Shariah compliant companies which capture more than 65 percent of the total market cap. PSX’s winning this accolade shows that it is a premium platform for listing and investing of Islamic capital market products. It is a testament to the excellence of the regulatory, operational, technological standards and products offered by PSX in providing superior Islamic products and facilitating Shariah-compliant equity and debt listings.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

*As of September 15, 2023

Published On: October 01, 2023

In its efforts to bring Pakistan Stock Exchange’s (PSX) functionalities and operations in step with the digitised world, PSX has digitised its listing process from end to end. Through an online portal called ‘PRIDE’ (Public Offerings Revolutionized through an Integrated and Digitized Experience), PSX has revolutionised the listing process.

Through PRIDE, Lead Managers, Advisors or Consultants can submit online applications & documentation for listing of equity, debt, mutual funds and Exchange Traded Funds (ETFs). The online portal allows for multifold applicability in that it provides for filing of listing applications, simplified tracking of listing applications and record retention. Moreover, this portal allows both the SECP and PSX to use this platform to share their approvals with issuers of equity and debt securities.

PRIDE can be utilised by companies or consultants to submit documents against Reverse Merger or Voluntary Delisting as well. The soft launch of PRIDE was conducted in December 2021, subsequent to which Listing and IT Units of PSX worked on addressing areas of improvement based on feedback received from Consultants, Advisors and Lead Managers. The PRIDE portal now offers advanced features for an enhanced user experience.

After launching PRIDE, PSX presented the webpage called ‘Public PRIDE’. This is a variation on the PRIDE system in that Public PRIDE is a one-stop solution meant for investors and general public to keep them updated on all information regarding upcoming public offerings as well as the investment avenues available in the primary market. Through this facility, the general public, including investors, can keep abreast with the status of listing of Main Board companies as well as Publicly Issued Debt on PSX in a transparent manner. Public PRIDE can be accessed online at: https://www.psx.com.pk/psx/pride.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: October 01, 2023

In its ongoing path towards digitisation and provisioning of electronic facilities for its stakeholders and market participants, Pakistan Stock Exchange (PSX) has digitised the shares subscription process. In other words, PSX has enabled electronic filing of shares applications in an IPO. This is called the E-IPO or Electronic Initial Public Offering facility.

The E-IPO system from PSX significantly transforms the process of shares subscription in an IPO. It brings the IPO process on an electronic platform thereby significantly easing the way investors can subscribe to shares in an IPO. It confirms with international standards and enables the ordinary investor to invest in an IPO through the digital platform.

The E-IPO system is an automated system connecting investors, share registrars with brokers/ TREC Holders and banks through payment gateways like 1-Link and the shares custodial company, CDC. Through the E-IPO facility, payments against shares subscription can be made in real time through all commercial banks operating in Pakistan.

With the E-IPO facility, PSX has proven that it is determined to take the lead and bring the capital market in line with global trends & international standards by connecting investors, share registrars, brokers, banks, gateway firms and the shares custodians, CDC, in providing a fast, efficient, and conducive experience for all participants of the IPO process.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: October 01, 2023

The HBL Total Treasury Exchange Traded Fund (HBLTT-ETF) is a first of its kind of Exchange Traded Funds (ETF) to be listed on Pakistan Stock Exchange (PSX). The ETF, launched by HBL AMC, consists of a blend of Government Debt Securities (GDS) as the underlying asset class. This security is structured in the ETF form so investors can easily invest in a diversified pool of fixed income GDS.

The HBL Total Treasury ETF’s underlying assets consist of cash and cash equivalent, Treasury Bills (T-Bills), and Pakistan Investment Bonds (PIBs). Specifically, the ETF invests in a particular basket comprising of Government of Pakistan Securities, Treasury Bills up to 1-year maturity and Pakistan Investment Bonds of up to 10 years maturity as well as cash and cash equivalents.

It is an open-ended fixed income ETF which tracks its benchmark index, the HBL Total Treasury Index (HBL TTI). It is a perpetual fund whereby the units of the fund are to be bought and sold throughout the trading day like shares of other publicly traded companies. The closing NAV and the index performance of the ETF is available on PSX as well as the AMC websites for the benefit of investors.

Investing in government securities is now as simple as investing in shares at PSX. By purchasing unit(s) of HBL Total Treasury ETF, investors are investing in a diversified pool of fixed income GDS by doing a single trade through their brokers on the Ready Counter of the Exchange. Investing in Government Debt Securities through this low-cost ETF may be an optimum way forward for investors who prefer taking exposure in different asset classes and investment strategies including fixed income instruments and related securities. At the prevailing rates of return, investing in government securities is an attractive option and investors must avail this option of conveniently investing in government securities through the HBL Total Treasury ETF.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: October 01, 2023

Pakistan Stock Exchange launched its first dividend-based index in September, 2022. This index, called the PSX Dividend 20 Index is an index based on the fundamentals of listed companies. The index tracks the performance of the top 20 dividend paying companies at PSX. The companies in the index are ranked and weighted based on their trailing 12-month dividend yield. This index is particularly helpful for investors in that it identifies high dividend yielding companies and facilitates investors in evaluating their investment portfolios. Individual investors, fund managers, Asset Management Companies, and investment banks, among others, can all benefit from this index.

Dividend is the payout that a corporate entity may choose to pay from its profits or surplus to its shareholders. Dividends are usually paid in cash and their frequency may be quarterly, semi-annually or annually. A company’s dividend policy is declared by its Board of Directors.

To add to the knowledge of novice investors, dividend yield is the financial ratio used to measure the percentage return received from the dividend relative to its market price. It is the percentage dividend return earned by the investor. The formula for dividend yield is: Annual dividends per share/ Price per share.

The PSX Dividend 20 Index is rebalanced/ recomposed on a semi-annual basis. It serves as a benchmark for high income-seeking equity investors and for those market participants who are invested in high dividend yield stocks. The PSX Dividend 20 Index presents a ready stock selection in that investors do not have to have to research all listed companies to identify high dividend paying stocks. The PSX Dividend 20 Index thus saves time for investors who are looking to invest in high dividend yielding stocks.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: October 01, 2023

Overseas Pakistanis can benefit from investing in Pakistan Stock Exchange (PSX) by opening a Roshan Equity Investment account (REI). This account has been launched under the Roshan Digital Account (RDA) umbrella by the State Bank of Pakistan (SBP) and RDA offering banks.

Any overseas Pakistani who has a Roshan Digital Account can open an REI account within the RDA account dashboard by selecting the REI option in his/ her RDA portal or application. The next step involves selecting the preferred brokerage house and accepting the terms and conditions. Thereafter, the account holder transfer funds into his/ her REI account (CDC Account) and can invest on Pakistan Stock Exchange.

Roshan Equity Investment account is an excellent option for overseas Pakistanis to not only invest in Pakistan’s stock market but also to repatriate their invested funds as well as dividend income easily and without any hassle. The REI account holder can do so without requiring any permission(s) from the SBP or the RDA offering banks.

Availing the REI option opens up a window of opportunity for non-residential Pakistanis to build their wealth within Pakistan and reap the benefits offered by Pakistan’s capital market. The current valuations of stock prices in PSX are amongst the most attractive ones in the region. At the same time, companies listed on PSX are offering some of the highest dividend yields as compared to our regional counterparts.

For more information on REI, visit the PSX website at: https://www.psx.com.pk/psx/resources-and-tools/investors/rda-roshan-equity-investment-nrps The above webpage also includes the list of banks and brokerage firms offering REI facility, apart from more information and FAQs to guide overseas investors in investing on PSX through REI.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: September 01, 2023

KYC Sharing or ‘Know Your Customer’ Sharing is the buzzword these days delineating the facilitation of prospective investors opening an account with securities brokers or other service providers including banks, Asset Management Companies, and insurance companies. Before we talk about KYC Sharing, let us give a brief about KYC itself. KYC is the “Know Your Customer” process whereby service providers such as banks and brokerage houses assess the veracity of their customer’s identity. It is a process which takes place at the time of account opening for verification and identification of the individuals applying for the opening of their account.

In case of brokerage accounts, previously, the verification of identity of customers used to take place through a manual process enabled by a multiple-page brokerage account opening form. This was 12-15 page application form which was meant to be filled out by account holders in order to open their brokerage account. This was not only a cumbersome process for the customers themselves but also spelled out a significant amount of workload for the brokerage houses.

Now, however, as things have become simplified and digitised, so has KYC. Post-Covid and the facilitation and enhancement of digital platforms that it brought with it, KYC Sharing has become a reality. Under this facility, in case of the capital market, banks which have records of their account holders can share the information of their customers with brokerage houses opening the accounts of those customers. This way the cumbersome process of the multi-page form filling has been curtailed and now only an abbreviated form is required to be filled out by customers wanting to open a brokerage account.

The story behind KYC Sharing dates back to September, 2020, when the Roshan Digital Account (RDA) was introduced by State Bank of Pakistan (SBP) to facilitate Non-Resident Pakistanis (NRPs) to open a bank account with local banks through online or digital channel. RDA enabled account holders to have access to all conventional account services such as funds transfer, bill payments, and e-commerce, among other services. Gradually, the RDA portfolio of services was expanded with the support and cooperation of Pakistan Stock Exchange (PSX), the able guidance of the Securities & Exchange Commission of Pakistan (SECP), as well as partnering banks & brokerage houses to include Roshan Equity Investment (REI) account facility. Through the REI account, NRPs can open a brokerage account with select brokerage houses, allow sharing of their account opening information with the Central Depository Company (CDC) & National Clearing Company of Pakistan Limited (NCCPL), and invest on Pakistan Stock Exchange. It was the REI facility which led to the enabling of customer information sharing by banks with brokerage houses for NRPs. This was the foundation that capacitated the sharing of customer information by banks with brokerage houses for Pakistani residents & citizens as well. Before RDA, there were the regulatory as well as infrastructural barriers that limited the availability of KYC Sharing. However, now the regulatory frameworks have been upgraded to include KYC Sharing provisions to facilitate account opening through the online channels as well for local investors.

KYC Sharing has been a blessing in terms of the fact that it supports ease of account opening for service providers, specially for securities brokers of the capital market. This facility will go a long way in helping to increase the number of Unique Identification Numbers (UINs) and in facilitating investors to enter the capital market with ease and convenience.

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

Published On: september 01, 2023

Investors who want to invest in Shariah compliant companies can invest in more than 250* listed companies making up more than 65%* of the total market cap of listed companies on the Stock Exchange. These companies are Shariah compliant and offer investors the option of investment on the Stock Exchange in accordance with Islamic principles of finance.

In Pakistan, the process of Islamisation of the economy was started in 1977 when in light of the recommendations of the Islamic Ideology Council, Government of Pakistan introduced certain changes in the Banking Companies Ordinance and promulgated the Modaraba (Floatation & Control) Ordinance, 1980, to provide a legal framework for an Islamic financial system in the country.

In the 1980s, Pakistan Stock Exchange listed the first Modaraba. Presently, around 24 Modarabas are listed at the Exchange. Subsequent to changes in the Law, various Islamic investment banks and Islamic commercial banks were listed at PSX. In 2008, Pakistan & Meezan Investments launched the Meezan Index (KMI 30 Index). In 2018, Shariah Governance Regulations were promulgated by the Securities & Exchange Commission of Pakistan (SECP). Government of Pakistan encourages Shariah-compliant listed companies by providing tax incentives. In 2020, Meezan Investment Funds launched the first Islamic ETF which was listed at PSX. The Meezan Pakistan ETF (MZNPETF) is the first Shariah-compliant ETF listed on PSX.

Pakistan Stock Exchange offers a wide range of stocks and debt securities which are Shariah-compliant. PSX has indices such as the PSX-KMI All Shares Index comprising of more than 250 companies and the KMI 30 Index as benchmarks to guide investors in their Islamic investment journey. The Meezan Pakistan Index, MZNPI, tracks the Meezan Pakistan ETF. The full list of constituents of the indices is available by clicking on the ‘Constituent Data (PSX Indices)’ option of the Daily Downloads section of the PSX website:

https://dps.psx.com.pk/downloads

PSX also offers Sukuks as Shariah-compliant debt securities as well as Modarabas and Islamic Mutual Funds for investors seeking to invest in Shariah-compliant instruments. Pakistan Stock Exchange is the ideal conduit of investment in Shariah compliant securities. It is no surprise that PSX has been awarded the Best Islamic Stock Exchange Award by Global Islamic Finance Awards (GIFA) for three consecutive years, 2021, 2022, and 2023.

For more information on PSX’s Shariah compliant investment facility, click on:

https://www.psx.com.pk/psx/resources-and-tools/shariah-compliant-investment

Disclaimer:

The contents of this article/ blog comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions

*As of September 15, 2023

Published On: June 01, 2023

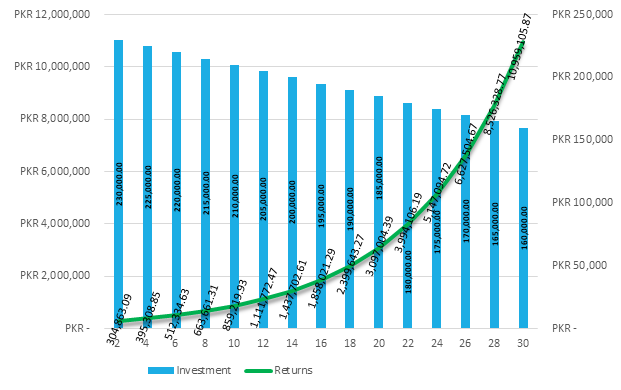

For many people, living the dream is the ultimate measure of success. But for many, achieving enough to live the dream is just an elusive goal which seems to be surrounded in a haze of fantasy and surrealism. For such people who are in doubt of how to earn in surplus, infact millions, we would like to be the harbinger of good news that there are ways to reach this objective. We will be discussing how to achieve these objectives with the promising note that the odds of earning millions through these strategies are far greater than making millions through a lottery ticket or a raffle draw. As a matter of fact, it just takes a lot of hard work, perseverance, patience and a sprinkle of stubbornness to keep at it, year after year, to earn the millions you want.