- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Published On: June 01, 2022

So you have some extra cash and money to throw around? But what if you don’t? We will show you how to save some and what to do with that extra cash.

Imagine you are working a nine to five job and your salary is Rs. 100,000/- p.m. Not so much, not so little! But you can do many things with it. One of the best things you can do with it is to start saving and investing. Start saving 20% of your income every month. As a rule of thumb, it is optimal to save atleast 20% of your income. Now don’t let this money sit idle. This saving may well be invested in mutual funds. Mutual funds have provided for a decent return of about 8-10% p.a. on average historically. So saving and investing Rs. 20,000/- every month in mutual funds, for a period of 1 year will leave you with Rs. 240,000/- as principal plus Rs. 14,400/- as profit @ 8% p.a. at the end of year 1, assuming the rate remains constant.

Now what do you plan to do with this money? Continue investing it in mutual funds and earn enough to beat the beast of inflation (Headline CPI recorded at 6.2% Y-Y basis as of Dec 2018)*? Perhaps this will not be enough for you.

What if you would like to spend this money? Would you like to buy that great sound system, that home theatre, that wardrobe or that jewellery for your wife on her birthday? If you are thinking along any such lines, think again!

You know there is so much that you can do with your money but there is so little that you can take from it if you just keep it idle or spend it right away. It will thus translate into a loss-making story. How about making this a profitable story?

First and foremost, keep some money aside for emergencies. Who knows what’s going to happen tomorrow. There could be the odd illness, an accident, a severe ailment that you or any family member can be affected by. What if your car gets damaged in an accident and you don’t have the cash nor the insurance to get it repaired. For that purpose, you need some funds. This is where your emergency funds will come in handy and help you in your medical emergencies or from your immobile state (due to car damage) in a country where a decent transportation system is almost non-existent. So keep some funds aside for your emergency needs.

Second of all, use some of this money to clear any debts that you might have. Credit card bills can be a huge bite off your monthly salary. So clear these debts and set yourself free. If you have any loan payments or installments against your car or your house, try to clear off a big chunk of these payments without affecting a whole lot of your savings.

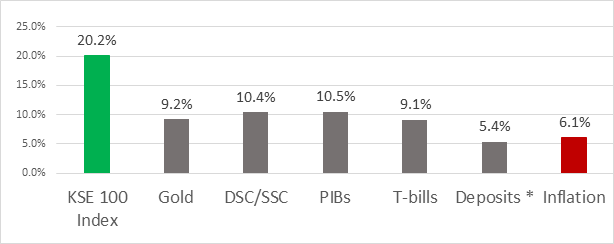

Thirdly and mostly importantly, you can now use your hard-saved & invested money and put it to good use. But how do you put your money to good use? The answer lies in further investment. There are multiple asset classes to invest into nowadays that provide for decent returns. You could invest in Savings Certificates, Treasury Bills, PIBs, Commodities, Money Market, Real Estate, Mutual Funds and Stocks. Each asset class has its pros and cons. If you keep your funds in savings accounts, while the funds are risk-free, the returns are nominal. In case of Savings Certificates, while the returns are competitive your funds may be locked-in for a long time. In case of bonds, the returns are competitive but there may be some limitations in terms of the tenure involved etc. Of all these asset classes, historically, the stock market has provided better returns. This is illustrated by the graph below.

Historically, the KSE 100 Index stocks have given a return of 20.2%** CAGR (Compounded Annual Growth Rate) in the last ten years and about 15.13%*** CAGR in the last 15 years. These figures compare fairly well with the returns gained from other investment vehicles.

So select the brokerage firm you want to do business with, open an account, and start investing in the stock market. Whether you do so in equities or in mutual funds or both is totally up to you. Because stock or equity mutual funds comprise a pool of diversified portfolio of stocks which are professionally managed, hence investing in mutual funds along with direct equity/ stock market is a good idea.

If you invest Rs. 150,000/- of your saved funds in the stock market and let it compound for several years, you can get a good return in the end. Instead of keeping them in a savings account or investing these funds in any other investment vehicle, investing them in the stock market for a period of five years, for example, can get you Rs 376,369/- (+), assuming the rate remains constant. This is more than double of what you started off with!

This shows that investing in the stock market is not only a better proposition than investing in any other asset class in terms of returns, historically speaking, but it will also equip you better in shielding your funds from inflation. Just with 20% of your salary saved & invested for a period of one year, you can save for emergencies, pay off some of your debt and invest in the stock market (&/or mutual funds) and thus come out on top with a return of Rs 376,379/- (+) after five years of investment. So save better, invest better, and reap the rewards of investing in the stock market!

Disclaimer:

The contents of this article comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions.

*(Source: SBP) // **(From Jan 2009 to Dec 2018)// ***(Dec 2003 to Dec 2018; Source: Bloomberg)// + (@ 20.2% CAGR)