- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Published On: June 01, 2022

There was a time when shares bought and sold through the Stock Exchange were in physical form. These physical shares or paper shares were cumbersome to handle, if in large number, and were difficult to take care of. Over the years, their physical condition would deteriorate and they could, therefore, lose their value or worth or they could get lost. With the growth and expansion of Pakistan’s capital market, the number of physical shares also increased exponentially and handling them became a burdensome process. In 1997, the Central Depository Company started its operations. The CDC brought about a revolutionary change in that shares were changed from paper to electronic form. In other words, since the introduction of Central Depository System, the shares of companies listed on the Stock Exchange have been bought, sold, transferred and held electronically. In 1991, Pakistan Stock Exchange became an electronic platform and henceforth the transition from manual to electronic processes took place.

Many investors have shares in physical form since they were bought by these investors many years ago, before the introduction of the electronic or book entry form of shares. A lot of people think that paper shares are obsolete now and do not carry any value. On the contrary, they are valuable assets held by the investors and it is important to get these shares converted into electronic form lest the paper material of the shares deteriorates over the years and also to make the shares easier to handle in terms of drawing dividends, buying (more) or selling shares, or for transferring or gifting the shares to others or family members. Infact, as per the Securities & Exchange Commission of Pakistan’s (SECP) Companies Act 2017, within a certain timeframe (not specified yet), the physical shares will cease to exist. Therefore, it is imperative that shareholders convert the physical shares in their possession into electronic shares as quickly as possible. This conversion of physical shares into digital or electronic form is also called Dematerialisation or commonly referred to as Demat. Presently, there are around 200,000 investors who hold paper shares in Pakistan.

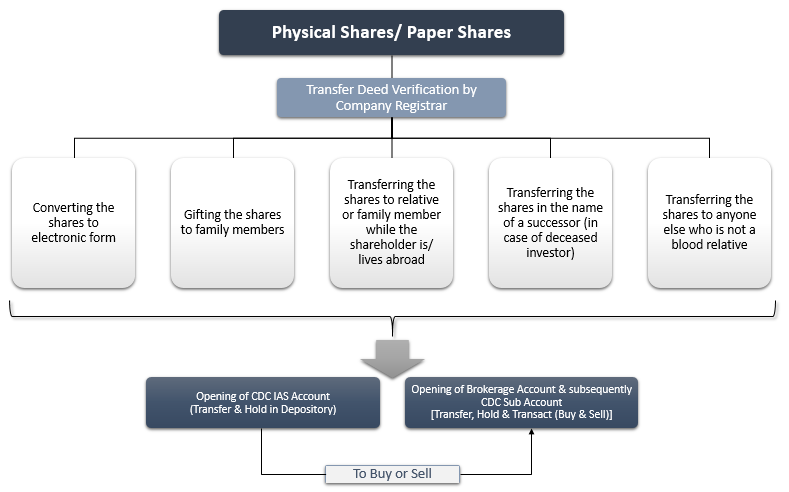

To summarise at the outset, if an investor holds physical shares and wants to:

For the above, the steps to be followed are:

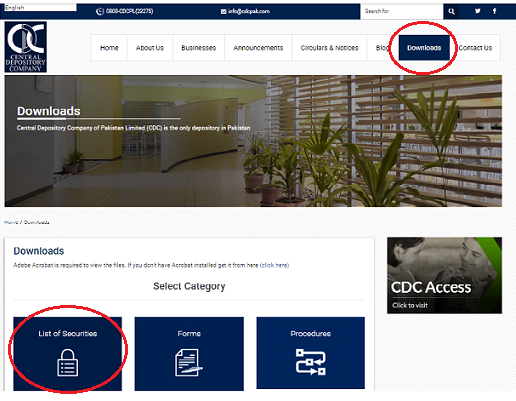

To convert physical shares into electronic shares, an investor needs to contact the share registrar of the company he/ she owns the shares of. Investors can find the share registrar of the company they own shares of through the CDC website, www.cdcpakistan.com, by clicking on Downloads, then browsing the List of Securities.

Once an investor has identified the name of the share registrar, he/ she can get the Transfer Deed (accompanying the physical shares) verified from the registrar which is essentially a verification that the shares actually belong to the shareholder. The investor then needs to open a CDC Investor Account or a Brokerage Account leading to a CDC Sub-Account with a broker and get these physical shares converted into electronic shares. A small amount against the head of Stamp Duty is charged for conversion of physical shares into book-entry form of shares.

In cases where family members gift physical shares to their children, such as a father gifting his paper shares to his son or daughter, there is a process to follow whereby the recipients of the shares can become lawful owners of these physical shares. The process includes getting the Transfer Deed verified against the name of the transferor and transferring them in the name of the transferee through the Registrar. Thereafter, the shares can be converted into book entry form by opening a CDC Investor account or CDC Sub Account, if not already opened.

Where a Transfer Deed is in open state, i.e. the transferor has signed on the Deed but the transferee signature is open and not signed yet, such Transfer Deed is said to be in ‘Street Name’.

In case where the investor or shareholder has passed away and the paper shares owned by the deceased shareholder need to be transferred in the name of his/ her children, then the way to go about is to start with a Succession Certificate. The Succession Certificate is a legal document which lists the successor(s) of the deceased. Recently, NADRA has also been authorised to issue succession certificates. The successor or prospective transferee of the physical shares will then approach the share registrar with the succession certificate who will transfer the shares in the name of the successor. These shares can then be converted into electronic form by opening CDC Investor account or CDC Sub Account, if not already opened.

For those relatives or family members who live abroad and want to transfer their physical shares to their relative or family member in Pakistan, the process is the same whereby the signature of the transferor which is required in the Transfer Deed is verified by the registrar and then the shares are transferred in the name of the transferee.

In case the physical shares are lost, a shareholder can take his/ her CNIC to the share registrar whereby, against the folio number of the shareholder, the registrar can retrieve the record of the investor and will re-issue the shares to the shareholder upon his/ her request.

Similiarly, for dividends not collected by a shareholder, the shareholder can approach the share registrar with his/ her CNIC and physical shares and request for the uncollected dividends to be re-issued to him/ her against those shares. The registrar will then retrieve the record of dividends issued to the shareholder in the past and re-issue the ones not collected by the shareholder thus far.

As mentioned earlier, having physical shares does not mean that they are useless now because electronic shares are being issued; but they are like valuable assets which need to be converted in another form, book-entry or electronic, for them to have utility in the capital market and be tradable. However, physical shares of bankrupt or closed off companies do not have any value. On the other hand, for companies which have undergone a merger or acquisition and have thus formed into a new entity, the shareholders of such companies can approach the registrar of the original entity and get new shares of the new entity issued to themselves in lieu of their old physical shares.

Disclaimer:

The contents of this article comprising of information pertaining to financial products, including but not limited to securities, derivatives products, listed companies or companies proposed to be listed on PSX and any content of third parties are strictly of a general nature and are provided for informative and educational purposes only. Such content/ information is not intended to provide trading or investment advice of any form or kind and shall not under any circumstances be construed as providing any recommendation, opinion or indication by PSX as to the merits of the said product, security or company and also not be interpreted as comprehensive and interpretive of all applicable regulatory provisions.

PSX makes no representations or warranties regarding the operation or availability of the Site or the reliability, accuracy or completeness of content available on this site. PSX has not prepared, reviewed or updated the content of third parties on this site or the content of any third party’s sites and holds no responsibility for such information.

PSX expressly disclaims that it shall not in any circumstances be liable for loss, claims and damages arising to any person or entity from reliance on such information including but not limited to where there are any errors or omissions in the content or information on the website. Users/ readers are advised to conduct their own research or seek independent professional advice from licensed entities prior to taking/ evaluating any trading or investment related decisions.