- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Pakistan Stock Exchange has embarked on a Financial Literacy Initiative to educate potential investors about investment basics, financial planning, and stock market investments. The Initiative seeks to educate the general public about defining their investment objectives, what to expect from the stock market, begin investing in the stock market, securing their brokerage account, dos & don’ts of investing in the stock market, and considerations while investing. The Initiative also seeks to educate the general public about the operational, strategic and regulatory developments taking place at PSX.

For any further information and queries regarding the Financial Literacy Initiative or for arrangement of Financial Literacy sessions for your organization/ institution, submit your query by clicking below.

Enclosures (for individuals):

Enclosures (for corporate entities):

You can invest and trade in the stock market through Active TREC (Trading Rights Entitlement Certificate) holders/ brokerage firms recognised by PSX and licensed by the Securities & Exchange Commission of Pakistan (SECP).

You must shortlist a number of brokerage firms based on your individual preference. You must talk to the shortlisted firms and make your final selection based on your requirements. You may select your brokerage firm depending on:

You want to live your life and follow your dreams. We all have a list of things that we want to achieve in our lives which require money to attain them. These may include goals for the near future like:

There is also a list of things you have to do in the distant future. These life goals may include:

All these life goals are achievable if you plan well, save early and invest prudently

While planning our investments we must also account for the unforeseen and emergency situations we may be faced with. Life is unpredictable and we can come across any situation like:

All the above need planning our investments. In order to invest, we begin with savings. We must invest our savings to ensure:

If you have thought of all of the above, Congratulations - You are ready to save and invest!

You can start saving as early as possible. Perhaps a chunk of your salary should be saved every month until you have enough to invest; a rule of thumb is to save 20% of your income. At the same time, if you have family support or other sources of income, a monthly addition of these funds can definitely help you save more until you have enough funds to start investing.

There are many savings & investment plans and products available in the market to choose from. If you keep your money in a bank account, you will get nominal returns on your savings. However, you are bound to get higher returns and cushion yourself against risk if you can invest your savings in a diversified portfolio of different investment vehicles such as:

It is always a good idea to invest your money where you get good returns.

The stock market is one such avenue where there is good upside potential, historically, and where the returns have been higher than those from other investment avenues. Investing for the long term is a better option than investing for the short term in the stock market. It will not only allow you to compound your earnings but will also enable you to earn dividends which can be re-invested in the stock market, thereby increasing your earnings. So you must focus on compounding your earnings, reinvesting your dividends, and achieving capital gain.

By purchasing shares of the selected companies, you build your portfolio of stock investments. This portfolio is formed and selected on the basis of:

By purchasing the shares of a company, you become a shareholder of that company and are entitled to dividends and other payouts such as bonus or right shares issued by the said company, along with the advantage you can have of capital gain from increase in price of the shares.

If you have decided to invest in the stock market, then it is a decision well worth taking. Consider this that Pakistan Stock Exchange has performed better over the last several years, above and beyond most other investment vehicles available in the country

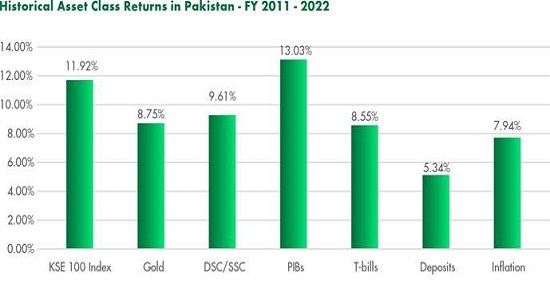

Returns earned from the Stock Exchange compared to other asset classes over the eleven year period ended 30th June 2022:

*Data as of 30th June 2022

*(Returns are shown on compounded annual basis)

The KSE-100 Index provided compounded annual returns of 11.92% over the last eleven years, June 30th, 2011 to June 30th, 2022. These figures compare fairly well with other avenues of investment in Pakistan.

The fact that the Pakistan Stock Exchange has given good returns historically, it is safe to say that investment in stocks in Pakistan Stock Exchange may well be worthwhile for the long run

The stock market is a place where companies list themselves to make their shares available to a broad range of investors to purchase these shares. You, as an investor, have the option to choose from multiple stocks of different companies to buy in order to build your investment portfolio. The share prices of the shares listed on the Stock Exchange fluctuate according to the buy & sell transactions taking place.

PRIMARY AND SECONDARY MARKET:

The main purpose of the stock market is raising of capital through investment in shares of listed companies. Listed companies are those which issue shares in the stock market to raise capital. This is done either through an Initial Public Offering or Rights issue.

An IPO or Initial Public Offering (Primary market) is the issuance of shares by a company in the stock market in order that its shares are purchased by the general public. Once the IPO has taken place, the shares continue to be traded in the stock market (Secondary market), changing hands between buyers and sellers.

Another way a company raises its capital is by issuing right shares at a certain price to existing shareholders. A shareholder interested in purchasing the right shares may do so if he deems it fit.

PSX & ITS LISTED COMPANIES:

Pakistan Stock Exchange consists of a list of more than 500 companies in more than 35 different sectors or industries. The total Market Capitalisation (volume of outstanding shares x share price) was Rs 8.24 trillion as of July 30th, 2021

WHAT IS AN INDEX & WHAT IS ITS PURPOSE:

Index is a grouping of selected companies’ stocks according to certain financial parameters in order to measure the performance of a section of the stock market.

INDICES LISTED ON PSX:

There are 14 Indices listed on PSX which are:

SHARIAH COMPLIANT INVESTMENTS:

For those investors who want to invest in Shariah compliant companies, there are listed companies on the Stock Exchange which are Shariah compliant. The PSX-KMI All Shares Index & the KMI 30 Index (KMI: KSE-Meezan Index) represent listed companies which are Shariah compliant. There are more than 200 companies listed on the PSX-KMI All Shares Index. The PSX-KMI All Shares Index & the KMI 30 Index were developed by PSX and Meezan Bank Limited. The listed companies’ Shariah compliance status is based on certain technical parameters and specifications as approved by a Shariah Board. In case of KMI 30 Index, it was approved by Shariah Supervisory Board of Meezan Bank Ltd., chaired by eminent Shariah scholar Justice (Retd.) Mufti Muhammad Taqi Usmani.

DEFINE YOUR INVESTMENT OBJECTIVES

A basic guideline is to understand what you really want from your stock investment

These are the basic questions you must address before investing

Optimally, you may want to invest in stocks for the long term, in order to earn dividends (periodically, through dividend yielding stocks) and for capital growth (gain in share price) over a number of years

YOU SHOULD DIVERSIFY YOUR INVESTMENT

As mentioned earlier, it is important to have a diversified portfolio of investments. You can have a diversified portfolio of stocks in order to cushion the effects of market downturns & volatility and to keep your total investment relatively secure.

You can diversify your portfolio by

EVALUATE YOUR RISK TOLERANCE AND CAPACITY LEVEL

You must evaluate how much risk you can take/ what is your risk tolerance level if the market takes a downturn.

Having a balanced portfolio with different market risk levels of shares and their returns is usually a good combination to build a portfolio of stocks.

You must also understand your risk-taking capacity. How much are you able to invest in the stock market in the face of the downturns and volatility it is undergoing?

STOCK SELECTION – LOOK AT THE PARTICULARS OF LISTED COMPANIES’ STOCKS

In order to select the companies you want to invest into, you may want to look at:

The above are some of the guidelines you may want to go by in order to select the companies you want to invest into.

WHEN TO ENTER OR EXIT THE STOCK MARKET

A lot of investors are usually confused when to enter the market and when to exit it. It is a safe proposition to enter the stock market when the Price to Earning ratios are low and the stock market is in an oversold position. Similiarly, it may be profitable to exit the market when the opposite conditions are true. But, as a general rule, it is not when you enter or exit the stock market, but how long you can stay in it.

After the selection of your brokerage firm, you will open a Brokerage Account. You must ensure that the said Account is opened in your name. You will be given a Client Identification Number or an Account Number against this account. Read the terms & conditions prescribed in the Account Opening Form and make sure that they match with the Standard Account Opening Form available on the PSX website.

Subsequently you will open a CDC Sub Account. The CDC Sub Account is the account where your purchased shares will be placed.

You are also encouraged to open a CDC Investor Account. This account is opened at the CDC, thereby adding to greater safety and individual custody of your shares.

You must make sure that you are assigned a Unique Identity Number (UIN). It is this number against which all your brokerage accounts and transactions will be recorded.

You will also need to deposit initial funds to purchase shares. Make sure that it is not a cash deposit.

Once you have decided which companies’ shares to buy, you should place your orders through your stock-broker (or through the online application provided by your brokerage firm)

After placing the order and execution of the same, you should get a Trade Confirmation against your executed order.

The shares purchased or sold are settled (payments made or received) through NCCPL (National Clearing Company of Pakistan Limited). The exchange of shares takes place through the CDC (Central Depository Company Limited). These two organisations and the brokerage firms/ TREC holders form the major part of the ecosystem of PSX.

Many brokerage firms offer Online Trading facility for its customers. This allows you as an investor to trade by yourself on the Stock Exchange through the online application or software.

There are several taxes and charges applicable on shares trading at PSX; the basic ones are listed as follows:

CGT (Capital Gains Tax) [Tax Return Filers: 15%, Tax Return Non-filers: 20%], Brokerage Commission [varies amongst brokerage firms], and CVT etc.

To help you safeguard your interest and to avoid complaints against the stock-broker, here are some easy tips:

BE WISE IN SELECTING YOUR BROKERAGE FIRM

ACCOUNT OPENING

STAY WELL DOCUMENTED AT ALL TIMES

BE THOROUGH IN TRADING PRACTICES

TAKE RESPONSIBILITY FOR INVESTMENT DECISIONS