- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Futures contract is an agreement between two parties to buy or sell the underlying shares at a certain date in future at a pre-determined price i.e. the futures price.

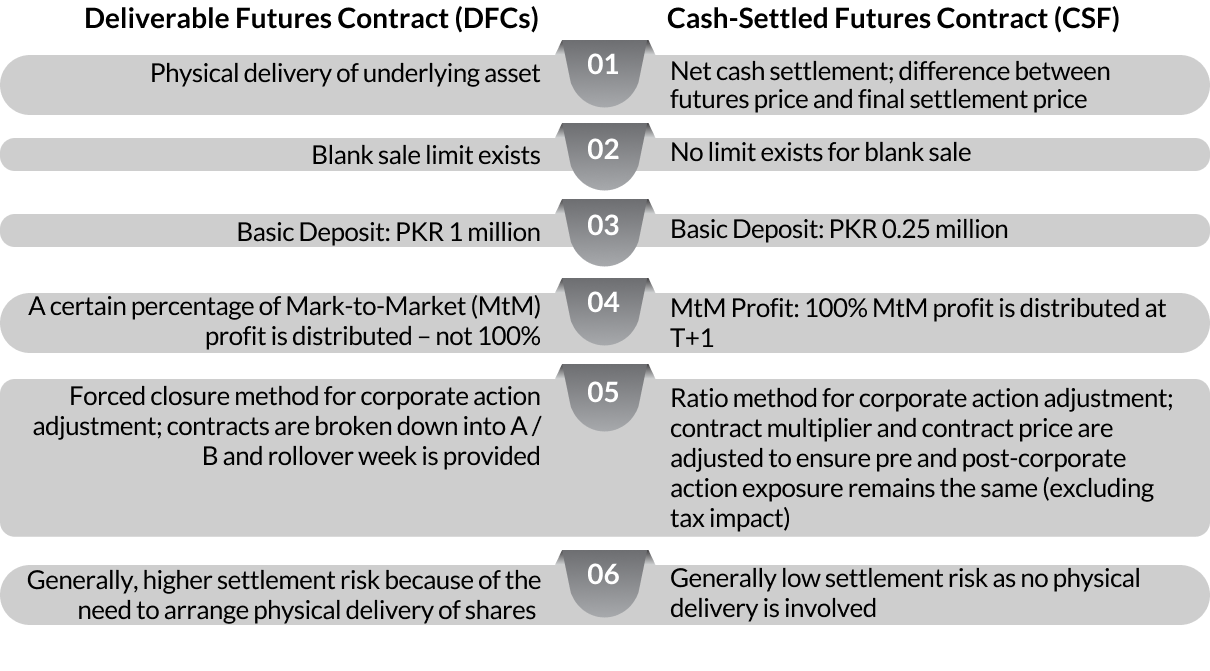

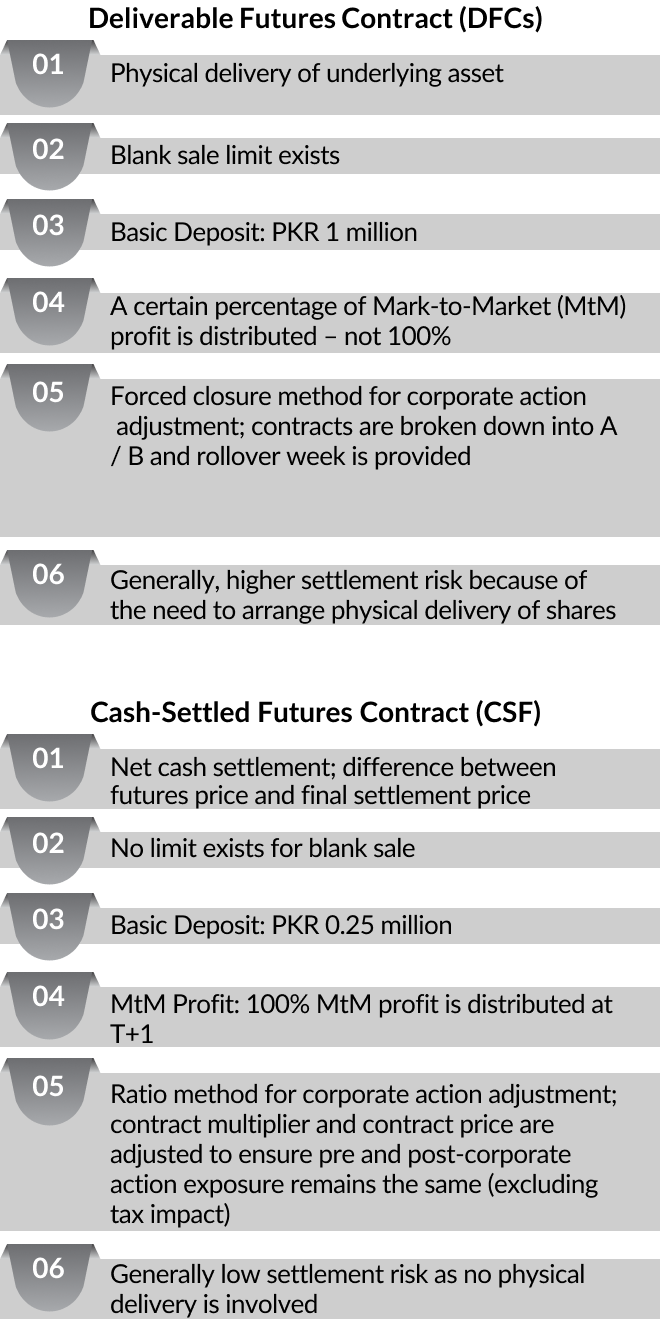

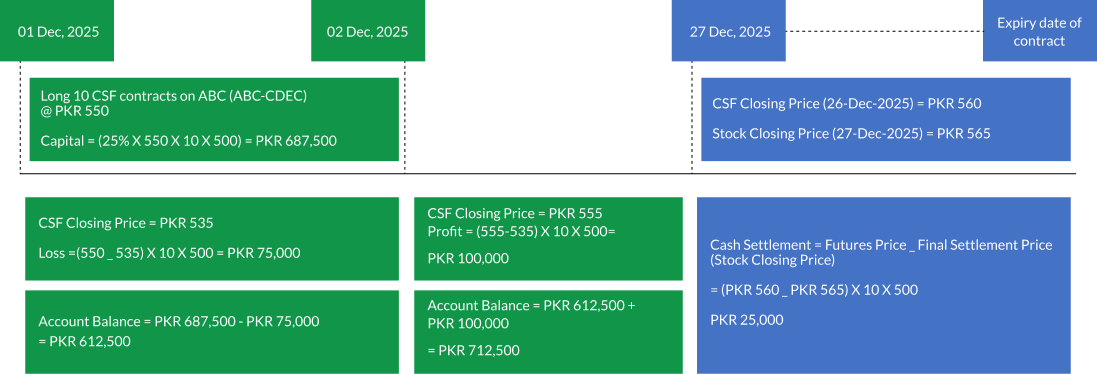

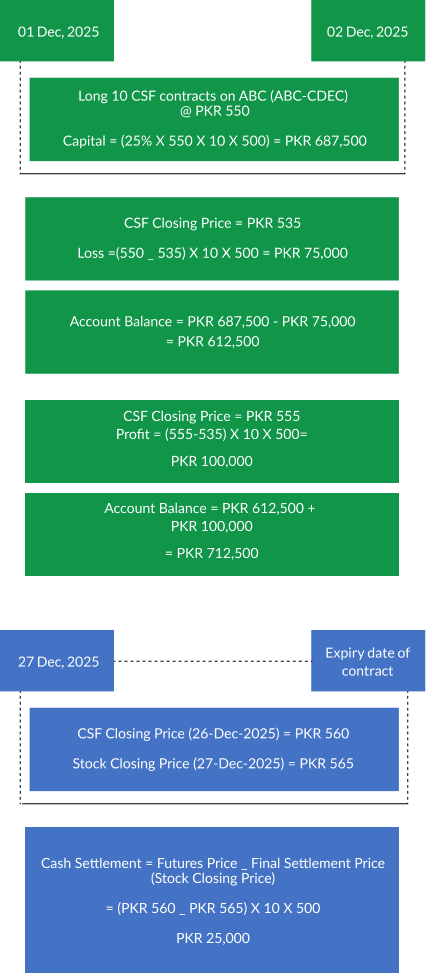

At expiry, unlike Deliverable Futures Contract (DFC), where investors must arrange the actual transfer of shares at expiry, Cash-Settled Futures (CSF) simply settle the difference between the future price on previous day and the final settlement price at expiry (underlying’s closing price) in cash.

It is ideal for investors in several ways:

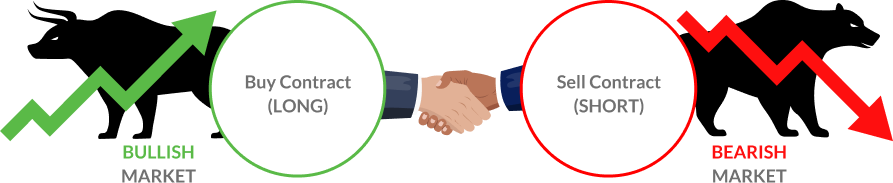

CSF contract involves 2 parties, namely:

1. Buy Contract (Long): Agreement to buy shares at a certain price and period

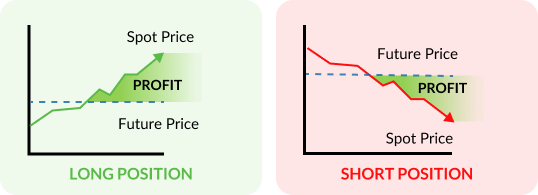

“LONG” CSF investors will gain profits if the spot price rises since they have locked in a lower purchase price (matched price) than the market price (spot price).

2. Sell Contract (Short): Agreement to sell shares at a certain price and period.

“SHORT” CSF investors will gain profits if the spot price falls since they have locked in a higher selling price (matched price) than the market price (spot price).

Mode of settlement is cash, where final settlement is the difference between futures price and final settlement price, simplifying the settlement process and avoiding the complexities of physical delivery.

CSF enable traders to benefit from both rising and falling markets. For instance, they can go long by purchasing CSF at a lower price in anticipation of a stock’s upward movement, or take a short position by selling CSF first and repurchasing later when expecting a decline in the underlying stock price, without the necessity of borrowing the underlying shares.

Investors can mitigate portfolio risk by taking opposite positions in CSF market. For instance, those holding a stock may hedge against a possible price drop by shorting the CSF on the same stock, or vice versa.

Because the margin needed to hold a stock futures position represents only a fraction of the future contract’s value, investors can engage in hedging or trading with a reduced capital requirement.

Unlike DFC, the MtM profit is fully distributed to the account holder by NCCPL on T+1, while its collection occurs on T+0.

| Features | Description |

|---|---|

| Eligible Stocks | Eligible securities as per approved criteria (reviewed quarterly) |

| Contract Multiplier | 500 shares for standardized contract (unless adjusted for corporate actions in the underlying stock) |

| Listing Date | First trading day following the last Friday of each calendar month |

| Listing Price | Theoretical price based on (i) underlying’s close price (ii) KIBOR (iii) days to maturity and (iv) spread |

| Maturities | 1, 2 and 3 months |

| Symbol |

Stock Ticker-CExpiryMonth (OGDC-CDEC)

– for standardized contracts Stock Ticker-CExpiryMonthNn (OGDC-CDECN1, OGDC-CDECN2, OGDC-CDECNn….) – for non-standardized contracts |

| Lot Size | 1 contract |

| Minimum Fluctuation | PKR 0.01 |

| Circuit Breaker | PKR 1 or 10%; whichever is higher |

| Order Types | All order types |

| Daily Settlement Price | VWAP in CSF or the theoretical price (in case of no trade during the day) |

| Expiration Date | Last Friday of the calendar month |

| Final Settlement Price | Underlying’s close price |

| Settlement Method | Cash settlement @ T+1 |

Traders can take advantage of mispricing between cash-settled futures and the deliverable futures contract, profiting from these price differentials

In CSF market, the investor’s profit/loss position is calculated daiy using the Mark-to-Market (MtM) method at the end of trading hours and will increase the balance in the client’s account at T+1 in case of profit, while in case of loss, MtM shall be collected at T+0. Unlike DFC, 100% of mark-to-market (MtM) profits are distributed.

In the event of a corporate action affecting the underlying stocks (dividend, rights or bonus issue), the contract multiplier, contract price, and free float of CSF contracts are adjusted to ensure that the investor’s exposure remains consistent before and after the adjustment (excluding tax implications). For DFC contracts, the impact of the corporate action was addressed by splitting the contracts into A and B series.

Example: ABC Company announces a dividend of 50%

| Before Adjustment of Corporate Action | After Adjustment of Corporate Action | ||

|---|---|---|---|

| Cum-Price – CSF Contract | Rs. 107.80 | Ex-price – CSF Contract | Rs. 102.93 |

| Contract Multiplier | 500 | Adjusted Contract Multiplier | 520 |

| Exposure | Rs. 53,900 | Exposure | Rs. 53,523.60 |

Notional Tax Filer Impact: PKR 377.27^

Difference per contract: (Rs. 0.8748)*

^Tax Rate = 15%

Any difference due to rounding-off impact shall be adjusted by NCCPL

Equity futures are financial contracts in which two parties agree to purchase/sell the stocks at a predetermined value. Their value is derived from, and directly linked to, the value of the underlying asset.

Equities, DFC, and CSF are distinguished individually:

The contract multiplier specifies the number of shares a single CSF contract represents. At PSX, contract multiplier for CSF is 500 shares, which means buying or selling 1 contract is equivalent to transacting 500 shares of the underlying stock.

All types of investors are allowed to trade in CSF market. Example, all individuals, institutional, funds, corporate clients, etc.

Yes, investors having a trading account with their respective brokers can start trading in CSF directly.

Investor should have an amount equivalent to the pre-trade margin (5%) and VaR margin for the symbol. VaR margin shall be different for each symbol.

Investors can sell or short immediately without first owning the CSF contract or its shares. Investor simply deposit funds for both buy and sell transactions.

CSF can be traded intraday and potentially generate capital gains from the difference in the CSF buying and selling price, just like stock trading.

Investors can carry over their CSF positions to the next day until the CSF matures without any additional fees. When investors carry over their CSF to the next day, the CSF transaction price will be marked to market at the end of each day, and the investor's account will be debited or credited with the resulting profit or loss.

Investors' open CSF positions will expire upon maturity, and investors will automatically receive funds based on the profit and loss amount, which is calculated daily through the mark-to-market process. The final day settlement shall be the difference between futures price and underlying close price.

CSF is a leveraged product that has the potential to generate higher profits compared to stock trading, but investors also risk incurring higher losses. If losses reach a certain value, investors may be subject to a margin call by the broker.

The prices of CSF and its underlying stock may vary during intraday trading due to market mechanisms, but generally, the CSF price will follow the price movements of its underlying stock. At the expiry of the contract, the CSF price will be marked to market with the price of its underlying stock i.e. the final settlement price.

CSF holders do not receive any corporate action directly like shareholders. However, CSF contract price and contract multiplier are adjusted to ensure the contract holder’s exposure remains the same, pre and post corporate action adjustment (excluding tax impact).

On the expiry day of the contract all open positions are expired/closed and positions are settled for the profit and loss using the final settlement price on the expiry day, which will be the closing price of the underlying stock.

On the last trading day, the clearing house will automatically close and settle your position at the final settlement price.

These limits are PKR 1 or 10%, whichever is higher.

The minimum lot size is 1 contract, while maximum lot size is 500,000 contracts.

09:30 am – 3:30 pm, Monday – Thursday

09:15 am – 4:30 pm, Friday (Namaz break from 12:00

pm till 2:30 pm)

Further information regarding CSF and other derivative products can be accessed through the PSX website at https://www.psx.com.pk/psx/product-and-services/products/single-stock-cash-settled-future.For further questions, please contact us by email at pd@psx.com.pk.