- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Magna Rohera

Assistant Manager

Strategy, Products & Data Science

Once upon a time in the bustling heart of Karachi, a curious 25-year-old named Ali arrived from a rural village, chasing a future shaped by ambition, hard work, and determination. He had always been captivated by tales of self-made individuals who transformed their lives not just with sweat and grit, but with clever choices and financial foresight.

One evening, while lounging at a friend’s place, Ali’s eyes fell upon an old, dusty book nestled on the coffee table. Inside were stories of legendary investors who had transformed their lives and the world through the power of saving and strategic investing. That moment lit a fire inside him, it was time to begin his own investment journey.

The First Lesson: Understanding Why Saving and Investing Matter

Ali reached out to Faizan, a close friend and seasoned investor who had weathered economic ups and downs with wisdom and resilience. Sensing Ali’s curiosity, Faizan happily assumed the role of a mentor.

Their first conversation was like opening the door to a new world. Faizan began with a stark reality: ‘Time and money,’ he said, ‘are the two currencies of life. Waste either, and you’ll pay the price.’

He spoke of the 2008 global financial crisis and the COVID-19 pandemic, both of which left millions jobless, businesses bankrupt, and families financially vulnerable. The lesson? Savings are one’s shield in chaos, and investments are their ladder to climb out of it.

The First Step: Budgeting for Freedom Before investing in stocks, bonds or any other investment avenue, Faizan emphasized budgeting as the starting point: ‘A budget is your money’s GPS,’ he quipped. ‘It directs where your money should go instead of wondering where it disappeared.’

He introduced Ali to the 50/30/20 rule:

This simple framework helps maintain discipline which is very essential on the road to financial freedom. ‘Discipline brings liberty,’ Faizan added. ‘It frees you from debt, anxiety, and the chaos of unpredictability.’

Setting Clear Financial Goals

With a budget in place, Faizan urged Ali to define his financial goals. These should span:

‘Goals give your money a purpose,’ Faizan emphasized. ‘Without them, income tends to vanish without a trace.’

Realities in Pakistan: Why Every Family Needs a Financial Plan

Faizan explained how Pakistan’s evolving family structures; from joint to nuclear households bring new financial responsibilities. Rising costs of living make emergency funds and insurance crucial.

He also highlighted the lack of retirement planning: over 65 million Pakistani workers are not enrolled in pension schemes, leaving many vulnerable in old age1. The reasons? Low financial literacy and lack of awareness.

‘As life expectancy increases and family support weakens,’ Faizan said, ‘planning for retirement is no longer optional, it’s essential for dignity and independence.’

Ali was surprised to learn Pakistan’s national saving rate is only about 7%2, much lower than neighboring countries. Faizan stressed that fostering a culture of savings and investment is critical not just for individuals but for the nation’s economic resilience.

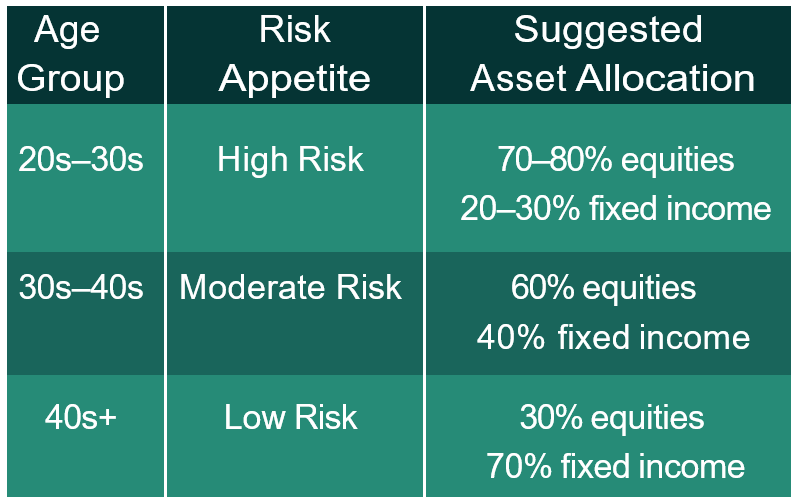

He also introduced the life-cycle investing strategy tailored to age and risk:

‘Start early to harness the power of compounding,’ Faizan advised. ‘The longer your money grows, the greater your wealth.’

Factors to Consider for Sound Investment Decisions

Before diving in, Faizan urged Ali to consider:

Navigating the Stock Market in Pakistan With Ali now convinced of the importance of saving and investing, Faizan took the next step and guided him through the process of opening a brokerage account to start trading at PSX:

Since Ali wanted to start with small investment, Faizan recommended opening a Sahulat Account which is a simplified account that only requires a valid CNIC, and allows investment up to PKR 1 million. Faizan also shared that many brokerage houses now offer online account opening, making the process faster and more convenient. The list of brokers with online services is available at ‘https://www.psx.com.pk/psx/online-accounts-opening’ .

Making Smart Investment Decisions

‘Ali, if you’re thinking of entering the stock market, do it wisely,’ Faizan said. ‘Consult registered brokers and aim for medium to long-term i.e. 3 to 10 years. Invest savings you won’t need soon, and diversify your money across different sectors that are not correlated.’

He leaned forward, lowering his voice. ‘Don’t fall for hearsay or hype. Research reports from brokers can really sharpen your judgment. Don’t invest all your savings, and definitely don’t chase short-term gains or unrealistic returns.’

Faizan paused, then added, ‘When picking stocks, check the company’s financial performance and future prospects. And always consider macroeconomic indicators like interest rates, inflation as well as geopolitics and industry dynamics, as these can turn market upside down.’

Overwhelmed by Stocks? ETFs Can Help

Ali was nervous about choosing individual stocks. Faizan suggested Exchange Traded Funds (ETFs) as a beginner-friendly way to invest broadly without picking individual stocks. He further explained that ETFs are baskets of stocks or bonds which trade on the stock exchange like individual stocks.

Currently, nine ETFs are listed at PSX, covering equity, debt, sector-specific, and Shariah-compliant strategies.

Here’s how the ETFs listed at PSX have performed since their inceptions:

Final Words of Wisdom

Faizan’s parting advice to Ali was simple but profound:

‘Investing is a journey. Start small, stay consistent, and let compounding work for you over time. Remember Warren Buffett’s wisdom, do not save what is left after spending, but spend what is left after saving.’ Empowered with new knowledge and a clear plan, Ali was ready to turn his dreams into reality, one smart financial decision at a time.